Y2K News Magazine

Yes, we all did survive it!

Y2K News Magazine billed itself as the World's Leading Bi-Weekly PRINTED Magazine & Information Source for the Year 2000 Computer Problem. This was their website.

Content is from the site's 1999 archived pages.

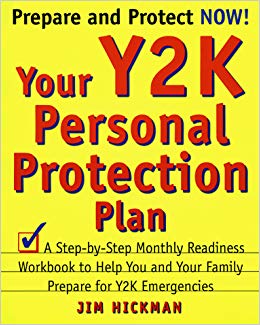

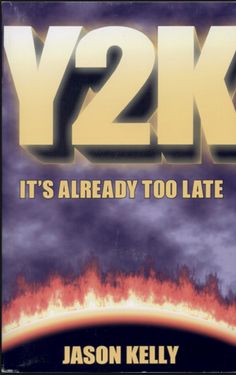

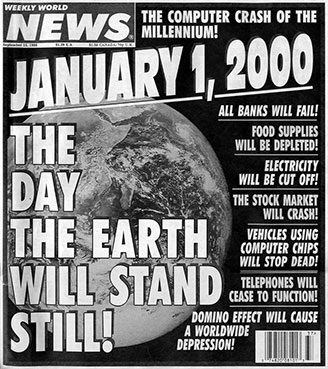

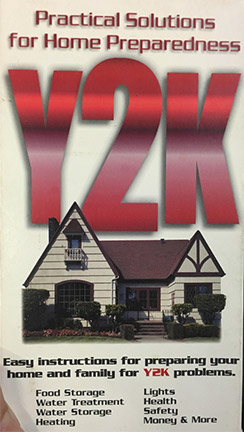

After all the hoopla, the dire predictions, the warnings, books for surviving Y2K, and articles surrounding Y2K, it's nice to look back and know we all survived!

Welcome to the Y2K News Magazine Discussion Forums!

Our discussion webs are divided into twenty separate discussions. Please choose a category and join us; share your experiences, solutions and ideas about the year 2000 problem.

The Y2K Problem

The problem is... Legal | Social | International | Survival | Software | Business | Power Grids | Government | Transportation | Communication | Banking | Investment

It is a problem which has reared its head with a variety of names over the last several years - the millennium bug, Y2K, The Year 2000 Problem - but, by any name, the problem remains the same, and it poses a significant threat to our worldwide economy and, possibly, to our own personal survival.

The problem arises from a simple, yet egregious error. Back in the early 1960's computer programmers creating the first electronic computing systems made a decision to minimize memory processor usage by designating the year as a two-digit function rather than a four-digit function.

For example, the year 1998 is recognized digitally by the code "98". The problem becomes ugly when the date rolls over from "99" to "00" on Saturday, January 1, 2000. Many older computers and embedded electronics will recognize the date not as January 1, 2000, but instead as January 1, 1900.

The confusion may result in any number of scenarios. If the processors fail to recognize the "00" as an actual value, they may get stuck in an endless loop, looking for a viable value and causing machinery and electronic systems to stop functioning. Or, systems may recognize the value as 1900 or some other previous date (many default to 1980) and wreak havoc on electronic billing systems and time management systems which run continuously and rely on accurate dates and times to function properly.

Although the specifics of the problem are isolated in the technology, the effects of the problem will spread to all facets of our society.

The government has already issued statements that specific divisions of the Executive Branch of the Government will not be compliant by January 2000.

Leading economists such as Dr. Edward Yardeni are predicting a 60% chance of economic recession as a result of business failures after the year 2000.

Electric power utilities that rely on the nuclear power industry and embedded technology may collapse under the strain of computer failure and Federal shutdowns.

Transportation and Communications systems may fail due to the prominence of embedded microchips in satellites and scheduling systems.

Obviously, the year 2000 problem has the potential to critically affect our worldwide society in a number of concrete ways. Analysts have predicted varied results of the problem, ranging from a non-event to total economic collapse of the planet.

Although the outcome of the problem is uncertain, the problem itself is very real. It is up to each of us to remain informed and educated about the problem, and to be prepared for the possibilities that may become realities.

SOLUTIONS

By subscribing to Y2K News Magazine, the world's leading bi-weekly news magazine for the Year 2000 Problem, you can become an informed member of society and read the news as it happens. As awareness grows, it will be vitally important to distinguish fact from rumor and know exactly how Y2K will affect you, your family, your business, and your community.

~~~~~~~~~~~~~~~~~~~~~~~~~

The tongue in cheek article regarding calling Batman to save us got rave reviews from the most unexpected places. The post suggested that only Batman could address an evil this devious and widespread and that he would come if we all cooperated. A group of editors posed for the photo each wearing a different Batman t shirt and some also wore masks. They also shared their online t shirt source with their staffs and subsequent photos revealed large crowds all wearing Batman shirts. There was a lot of discussion about all things Dark Knight, including some focused on his famous ride, the Batmobile, and they shared links to this page which goes into great detail about this special car. The point was that if Batman was summoned, he would arrive, even if only in spirit, in the minds of those who could actually address the myriad problems associated with the y2k bugs (yes, plural). The conclusion pointed out that it must have worked because the disaster was nowhere near as bad a predicted, so the Dark Knight was with us and saved the day without actual villains having to be harmed!

NEWS ARTICLES

Safety hazards loom at day-care centers

By Jayne O'Donnell, USA TODAY 04/11/99- Updated 11:40 PM ET

Year 2000 could cripple health system

By Reuters

Special to CNET News.com

March 1, 1999, 4:00 a.m. PT

WASHINGTON--The Year 2000 computer bug could cause havoc for the nation's Medicare system, interrupting health benefits for millions of old and sick Americans, congressional auditors say.

Joel Willemssen of Congress's General Accounting Office told lawmakers that the Health Care Financing Administration, which helps pay medical bills for more than 70 million people, was nowhere near ready for the so-called millennium problem, which could generate computer system crashes and errors January 1.

"There is a high probability that there will be some system failures," Willemssen told the House subcommittee on government management, information, and technology Friday.

As a result of these problems, GAO said, billions of dollars in federal Medicare and state-administered Medicaid health benefits could be delayed, miscalculated or go unpaid, leaving the poor, elderly and sick without the money to pay their doctor bills.

The finance agency, which is part of the Health and Human Services Department, said the GAO was overstating the risks.

"I want to personally assure beneficiaries that the care they have come to expect from our programs will continue throughout the millennium transition," the agency's administrator, Nancy-Ann DeParle, told the subcommittee.

The problem is that many computers as now configured cannot recognize 2000, confusing the abbreviation of its last two digits--"00"--with 1900. To save expensive disk space, early programmers tracked dates with only the last two numbers of the year. This could cause many computers to go haywire come January 1.

According to lawmakers and congressional auditors, the Health Care Financing Administration is one of several federal agencies lagging behind in Year 2000 computer readiness.

A congressional report released last Monday singled out the Federal Aviation Administration, the State Department and the Agency for International Development for failing to prepare.

GAO said the risk at HCFA was particularly acute. More than 150 different computer systems are used by the agency in administering the Medicare program. As the nation's largest health care insurer, Medicare expects to process more than a billion claims and pay $288 billion in benefits annually by 2000.

The consequences, then, of its systems' not being year 2000 compliant could be enormous," Willemssen said.

GAO said Medicaid--a joint federal-state program supported by HCFA and administered by the states--was also at risk because some states were falling behind in upgrading their computer systems. Medicaid provides about $160 billion in health coverage for 36 million low-income people, including over 17 million children.

DeParle said fixing the administration's computers for the Year 2000 bug was her top priority. She said progress was being made and many critical systems were already prepared. "I am confident that HCFA's own year 2000 systems issues will be resolved well before January 1, 2000," she said.

Willemssen said HCFA was overstating its readiness. He said many of these computer systems were still vulnerable to crash and urged DeParle to improve her contingency planning.

IRS irons out Y2K glitches but mistakes possible

The Associated Press

The Internal Revenue Service is confident its computers are ready for the Year 2000, but taxpayers should watch out for any unexplained glitches.

“We’re going to try to avoid these things, but they could happen,” said IRS Commissioner Charles Rossotti. “Although there might be some inconvenience, we’re not going to allow any taxpayer to suffer any financial harm.”

Computers worldwide that use two digits for years could recognize 2000 as 1900 unless their software is fixed, which would create havoc in information systems used by government and business.

Much of the work on mainframe computers — the ones used by IRS for processing refunds and payments — was finished prior to the 1998 tax return filing season. There were some errors last year in computation of penalties and interest and in some notices for taxes due.

“It did occur, but it wasn’t a big fraction of the total,” said John Yost, who oversees the effort at IRS, said. “Overall, we had a good filing season.”

Now most of those bugs have been ironed out. This year, the IRS computers that deal with customer service and with collections and audits will have the new lines of rewritten code.

Despite testing, the sheer scope of the changes and the complexity of tax laws make mistakes possible. Yost, however, said the major danger is that some programs just won’t work.

Independent observers say IRS has done a good job of dealing with the Y2K problem. Rep. Steve Horn, a California Republican who chairs the House subcommittee on government management, said many in Congress who were “convinced that IRS wouldn’t make it” have been pleasantly surprised.

Taxpayers who believe they’ve gotten inaccurate IRS tax information, notices or other data should call the agency at 800-829-1040.

GAO says HCFA will fix Y2K bug in time

March 1, 1999 DAILY BRIEFING

By Basil Talbott, CongressDaily

A General Accounting Office official testified Friday that the Health Care Financing Administration exaggerated how much progress the agency has made in fixing its year 2000 computer problems, but said he was nonetheless confident that HCFA is on the right track.

Joel Willemssen of the GAO gave the agency that handles all Medicare and Medicaid payments high marks, but said "the system is not Y2K compliant" and predicted it would not meet President Clinton's government-wide deadline of March 31.

Citing a Feb. 10 report, he told the House Government Reform Management, Information and Technology Subcommittee that HCFA "considerably overstated" the progress it made in bringing its "external mission-critical systems"—outside systems that process claims—into compliance. Of the 74 external systems that the federal agency reported compliant with standards at the end of last year, Willemssen said 54 still failed to comply.

Countering Willemssen's testimony was HCFA Administrator Nancy-Ann DeParle, who said her agency would make payments on time to health providers and beneficiaries by the year 2000. She said the evaluations in the agency's progress report were based on information from the people running the external systems and checked by her people. Problems were found, she said, but were "not significant enough" to declare them out of compliance.

DeParle downplayed discrepancies between her agency and the GAO, suggesting they were due to the lack of a paper trail. The GAO needs a paper trail to prove everything is in compliance with federal Y2K standards, and DeParle promised to produce one.

DeParle singled out the independent contractors and state agencies on which the agency depends as a source of concern. She related her difficulties in putting independent entities under new contracts to assure they are committed to bringing their data processing up to standard.

GAO has reported "some states and providers" will fail to do so by 2000, but HCFA has limited leverage over them, she said. The agency is exploring whether legislation is needed this year to help bring all systems in timely compliance, according to HCFA spokesman Chris Peacock.

Subcommittee Chairman Stephen Horn, R-Calif., expressed concern about the GAO's complaints, but praised the agency for its progress.

SOME CHRISTIANS FEAR THE END; IT'S JUST A DAY TO OTHERS

By Jeff Coen Tribune Staff Writer

March 01, 1999

In the religious world, the approach of the millennium has long evoked doomsday scenarios and apocalyptic prophecies. But the recent focus on the secular threat of a calamitous computer glitch--the Y2K Bug--has created a specific vehicle with which to link the cosmic and the down-to-earth.

And though most of these alarmist scenarios are being dismissed as products of fringe religious groups--critics say they can undermine or embarrass the true faith--even some mainstream Christians are publicly musing on whether possible chaos from worldwide computer failure could somehow be the contemporary manifestation of turmoil described in the Bible's book of the apocalypse that heralds the arrival of the Antichrist. Revelation obviously doesn't mention computers, but some in the Christian world think the confusion the Y2K bug could produce might be the sort of entry point for a figure to seize control of the world before Jesus Christ returns.

Wheaton College theology professor Donald Lake says Christians aren't alarmed about the date itself but about the real potential for major instability. Many fear the inability of computers and other electronic devices to conceptualize the date once 1999 becomes 2000 could lead to anarchy brought on by computer malfunction around the globe.

"Of course, there is a kind of natural human anxiety that people have about the future," Lake said, "and there are plenty of biblical passages that say that toward the end of human history, there are going to be perilous times and natural disasters."

"Is it possible that we are sliding into the end-time events that I have read about and heard about in my childhood and in my family and my reading of the Book of Revelation and other places in the Scripture?" Dr. James Dobson, one of the country's best-known Christian teachers, asked on a radio program on Y2K that his influential Focus on the Family ministry organization produced. Dobson's panel of experts, including perhaps the two leading Christian authors on the Bug, stopped short of saying yes, but they also did not push the question off the table.

Larry Spargimino, co-author of the 1998 book, "Y2K = 666?" a title referring to the "mark of the beast" in Bible prophecy, says, "In world history, whenever there's a major crisis, that's when totalitarian forces tend to take control.

"There are a lot of things that are going to go into end-time events, but with Y2K, it's being hastened," Spargimino said. "Y2K is a contributing, moving force that is pulling events in prophecy together quicker than we could have imagined."

And though local pastors and theologians have dismissed a swelling number of the alarmist Christian books, newsletters and Internet Web sites as representing the fringe of Christianity, some mainstream groups have at least taken notice.

Larry Eskridge, associate director of the Institute for the Study of American Evangelicals in Wheaton, said the Y2K problem has "opened the floodgates" on prophecy. Eskridge said that even most trusted Christian sources have picked up on the issue to urge at least a bit of planning, because the Bible suggests in books such as Proverbs that a wise man is a prudent one.

And a handful of large churches--with or without official stances on the Millennium Bug--also have been the sites for flea market-like sales of paraphernalia designed to help people survive a crisis. Merchandise ranges from gold coins to wood-burning stoves.

But many pastors in the Chicago area said they are concerned by those who suggest too loudly that Y2K could lead to Armageddon and the second coming of Jesus Christ.

Erwin Lutzer, pastor of Chicago's Moody Church, said such views can hurt the credibility of Christians when they don't come true and lead to unnecessary panic. Although some people suggest that fleeing to a well-stocked bunker in the Rockies might be a wise idea as 2000 looms, Lutzer said heading for the hills is not the biblical response.

"I told the people at Moody Church that I was opposed to those who would say, `Let's move to Arizona and buy a little plot of land and some attack dogs and guns and watch the rest of the world deconstruct,' " Lutzer said. "The Bible says if your neighbors are hungry, feed them."

Those who would try to predict that Jesus Christ will come back to earth because of the millennium date or the Y2K bug could make the church look foolish, Lutzer said.

Lake said many hung prophecy on the 40th anniversary of the creation of the modern nation of Israel in 1948. Forty years is often a key Biblical measure of time.

"I had friends who thought for certain that the second coming of Jesus would be in 1988," Lake said.

Both Lake and Lutzer pointed out that those who would link predictions to the next millennium already have been disproven. Many religious scholars believe the Gregorian calendar is off and Christ actually was born in 4 B.C., Lutzer said.

"The year 2000 itself is a human concoction," Lake said.

Perhaps that explains why the apocalyptic visions some evangelical Christians tie to Y2K apparently have not carried over into other major religions.

Inam Haq, director of the school of the Islamic Foundation in Villa Park, said prophecy in his religion deals with the disintegration of the family and moral corruption, and anyway, next month begins year 1421 in the Muslim calendar.

Rabbi Victor Mirelman of the West Suburban Temple Har Zion in River Forest said the messianic writings of Judaism also have no ties to anything related to Y2K, the year or the bug. "Nothing in Judaism would pertain to it," Mirelman said, "and according to our way of calculating time, the year is 5759."

Some local church leaders contacted recently said they are offering information on the bug or recommending books on it to members, but the decision to store food and water or adjust savings is being left for individuals to make.

"We haven't been trying to tell people how to think," said Mark Burgund, a pastor at Naperville's Calvary Temple Church who has taught Sunday school classes on the millennium problem. "There are some extreme alarmists out there and some head-in-the-sand kinds of views. We've tried to be balanced and tell people that you don't have to run scared--you put your trust in the Lord."

County officials meet to plan 2000 strategy

By Jeff Cole

of the Journal Sentinel staff

March 1, 1999

Port Washington -- If the Y2K computer bug does its worst in Ozaukee and Washington counties, it would be as if a bad ice storm hit the two counties, officials in both counties said Friday.

What Y2K won't be is Armageddon, the officials said.

"On Dec. 31, you should have on hand in your house a week's worth of your needs," said David W. Barrow, one of the consultants working with Ozaukee County on the so-called year 2000 bug, or Y2K. "You should do the same thing as if you heard a big snowstorm was coming."

Most people will probably have some minor disruptions, said Ozaukee County Supervisor Gus "Sandy" Wirth, who leads the County Board's Information Services Committee. However, people will have heat, lights and other essentials, Wirth said.

The Information Services Committee met with Ozaukee County's department heads to discuss what has been done and what still needs to be done to prepare for 2000.

One of the committee's key functions should be to assure residents that things are not going to be as bad as predicted, Ozaukee County Sheriff's Department Lt. Edward Hermann said.

The 2000 problem is a result of early days of computers. Back then, programmers often didn't put all four digits of the year in the area for dates, only the last two digits. Many now fear that when 2000 arrives, computers will be unable to read the last two digits.

Some have contended that the bug could bring a computer-dependent society to a halt, with power plants, air traffic control systems and banks shutting down. To solve the problem, experts are either altering a computer's programming or replacing the machine with a newer model that is Y2K-compliant.

"Actually, this hit the media just a little while ago, but programmers have known about this and have been working to fix the problem for at least two years," Washington County Emergency Management Director James Pamperin said. "I plan to treat this like any other potential disaster. I do not plan on having to open the Emergency Management Center on Jan. 1, 2000." One advantage Y2K planners have is that New Year's Day falls on a Saturday in 2000, Wirth said. That means people working on the problem will have two days to respond before the holiday weekend ends and people resume their normal routines, he said.

Ozaukee County is already far ahead of many other counties when it comes to preparing for Y2K, Wirth said.

The county already has researched and identified its needs in terms of solving the problem, consultant Ralph Evans of Evans Associates told the committee. It is working to correct problems wherever they are found.

"In some cases, we are getting letters from companies that say their equipment is Y2K-compliant, but the service guy is telling us they are not," Ozaukee County Buildings Superintendent Peter Waldkirch said.

The county plans to not take anyone's word for anything, Evans said. Every piece of equipment will be checked, he said.

"We have to hope for the best and prepare for the worst," Wirth said.

On the positive side, preparation for the Y2K bug is helping the county, Wirth said. Even if nothing happens, the county will have a comprehensive disaster response plan in place as a result of the planning, he said.

It also will allow an opportunity for residents to help their neighbors if problems arise, Wirth added. He said that "was a great opportunity for people."

A forum on Y2K for Cedarburg residents will be held sometime in late April, Light and Water Utility Manager Dale Lythjohan said. The utility is getting enough questions on Y2K issues to warrant a public forum, Lythjohan said.

Emergency officials ready for Y2K

Monday, March 1, 1999

By LESLIE J. NICHOLSON

Knight Ridder Newspapers

PHILADELPHIA -- The year 2000 computer problem will not be a catastrophe for the United States, federal officials say. Nevertheless, they note, people should expect isolated service disruptions, which may occur simultaneously.

"Based on current assessments, the sky is not falling," Mike Walker, deputy director of the Federal Emergency Management Agency, told a group of state and local emergency-management officials last week. "There is no indication that Y2K will result in national disruption of America's basic infrastructure."

Such reassuring words were echoed several times Thursday in one of a series of Y2K workshops that FEMA is holding nationwide. The two-day workshops, closed to the public, are meant to help emergency officials -- primarily on the state level -- prepare for Y2K so they can assist their county and local counterparts.

FEMA would get involved with Y2K problems only if smaller governmental agencies exhausted their options, officials said. "All disasters happen at the local-government level," said Lacy E. Suiter, FEMA's executive associate director for Response and Recovery. "When it gets to where we are, you're kind of at the last resort."

The Y2K problem can occur with computers and high-tech devices that are programmed to use two digits to represent the year. If not fixed, some systems may read "00" as "1900" rather than as "2000," causing the systems to fail or produce inaccurate data.

The FEMA workshop has drawn emergency managers, fire marshals, and Y2K coordinators from Pennsylvania, Delaware, Maryland, Virginia, West Virginia, and the District of Columbia.

After hearing generally upbeat progress reports Thursday from several key federal agencies, the American Red Cross, and the U.S. Army Corps of Engineers, the 160 delegates retreated into closed-door sessions to discuss action strategies. Topics included how to control rumors and maintain public confidence, and how to handle system failures.

Speakers said the nation's energy, telecommunications, transportation, financial, and health sectors were generally in good shape for Y2K, although there are trouble spots with small businesses and small towns. The problem is of global proportions as well.

For example, Janet K. Benini, deputy director of the U.S. Department of Transportation's Office of Emergency Transportation, said she was concerned about the Y2K status of small transit agencies and of international maritime and airline systems.

Jim Markis, director of the Environmental Protection Agency's Chemical Emergency Preparedness and Prevention Office, said the nation's water and waste-handling systems should experience few problems. But the chemical industry -- especially small companies -- has gotten off to a slow start, he added.

Markis said the EPA had just issued an alert to chemical companies regarding Y2K. Meanwhile, he said, the EPA has waived penalties against companies that violate environmental restrictions while testing systems for Y2K readiness.

Some agencies offered a glimpse into the contingency plans they have in case the worst happens.

The Coast Guard, for example, plans to use cutters as backup communications hubs. Benini said that if radar systems fail, the Coast Guard will have extra ships in place to observe vessel traffic.

Brian P. Carney is a representative of the National Communications System, which handles emergency telecommunications for the government. He said NCS was working on a system to warn U.S. telecommunications companies if New Zealand and other nations in earlier time zones begin experiencing problems when 2000 rolls around.

NCS is one of many agencies planning to have emergency teams on duty the night of Dec. 31. Carney joked that he would end up playing cards that night rather than dealing with Y2K crises.

~~~~~~~~~~~~~~~~~~~~~~~~~

What is your community doing to prepare?

From Atlanta to Oregon, Communities Prepare

by D.L. Moore

Across North America and around the world, people are coming together for the common good by forming groups to help mitigate the possible consequences of Y2K. This 2nd in an on-going series on communities preparing discusses 3 different communities' efforts to "find strength in numbers."

Ground Zero for the Joseph Project 2000

Larry Baker, pastor of the Prayer and Praise Christian Fellowship and the Cherokee/Pickens County chapter of the Joseph Project 2000 (JP2000) (http://www.josephproject2000.org) in Woodstock, GA. enthuses how his church is "Ground Zero for JP2000." JP2000 was founded earlier this year by Shaunti Feldhahn after she had attended a Y2K awareness event in Atlanta.

At that meeting she met Don Baker, Associate Pastor from Baker's church and the two talked about what would later become JP2000. By mid-July, Feldhahn had laid the groundwork and staffed by volunteers, JP2000 hosted a pastor's meeting the first week of August. Approximately 65 attended, listening how they, too, could prepare their church communities for Y2K and how they could use their preparations as a springboard in ministering to their communities.

JP2000's headquarters are located at the church and to date are still staffed entirely by volunteers. The church serves as the first chapter for JP2000 and they are building on a pantry they already supported as part of a network of churches. With approximately 125 active members, Baker estimates 1/2 of the membership is participating in community preparations for Y2K.

The church is planning to increase the physical storage the church has available for supplies and in mid-December they are planning to dig a well. Situated on 15 acres, the church plans to utilize the acreage for growing crops, should the need arise. One church member has an additional 30 acres that could also be used for crops. In this rural area about 45 minutes outside Atlanta, farm machinery will be available for plowing and harvesting any crops they sow to supplement supplies from the food pantry.

In a concerted effort to address Y2K head-on, the church has begun educating their members through a series of training sessions conducted by Linda Hayes, a former missionary to Haiti and certified Red Cross Disaster trainer. Complimenting Hayes' training is former FEMA employee Marty Kelly who worked for the agency several years ago.

Kelly has been teaching classes and seminars on contingency planning and preparation. Food preparation and storage, electric power substitutes, and how to select, grind and prepare wheat for consumption are only a few of the classes she has hosted or is planning for the future.

Spearheading the community shelters for Y2K has become Hayes' task. As a result of a recent pastors' meeting, 12 churches have decided to form a Y2K preparation consortium to pool financial and physical resources. The buying power is greatly enhanced when several organizations can share the expenses and reduce costs by purchasing in much larger quantities than each could muster alone.

State of Georgia, CIO and Y2K Czar Michael Hale provides an update on Georgia'sprogress in meeting their Y2K compliance goals at JP2000 Y2K conference in Atlanta

Industry expert Jim Lord addresses attendees at JP2000 Y2K conference in Atlanta

On the heels of the August pastors' awareness event, a citywide event was held in September and attended by 3,000+ concerned citizens. Jim Lord, a national Y2K speaker, consultant and author addressed the crowd regarding the hows, whys and whens of Y2K.

Following Lord, Michael Hale, Chief Information Officer and Y2K Project Director for the State of Georgia spoke about Georgia's progress in addressing Y2K-related issues on the state level and their future plans in preparing the state systems to be Y2K compliant.

Nationally known financial advisor and president of Christian Financial Concepts in Gainesville, GA, Larry Burkett discussed how attendees should work to reduce debt and make sure they have copies of important legal documents and financial records. Burkett also challenged attendees to prepare financially and spiritually for Y2K by becoming involved and continue to keep abreast of developments in their communities and around the world.

Christian Financial Concepts founder and President Larry Burkett gives the audience an overview of possible financial disruptions as consequences of Y2K at the JP2000 Y2K conference earlier this fall

Oregon takes on Y2K Preparations

In early July, 3 people came together to discuss Y2K and the possible disruption of goods and services in the town of Bend, OR. From that humble meeting has grown what is now the Bend Oregon Y2K Community Neighborhood Watch Program. Currently the committee consists of approximately 20 members of the community and is sponsored by the Bend, Oregon, Ministerial Association, a consortium of area churches.

The Y2K committee hosted a public awareness event in late October on a Friday evening and Saturday morning. Both sessions were identical and designed to inform those who could attend either one or the other. Jack Anderson from Christian Financial Concepts provided the Y2K overview. Pastor Dan Dillard of the Grace Community Church and chairman of the committee spoke regarding the church's role in Y2K community preparation and support.

The committee has divided the 35,000 member community - 75,000 with surrounding areas included - into 4 quadrants along the 2 main intersecting streets. Currently they are recruiting for Quadrant Coordinators who will in turn recruit Neighborhood Coordinators from each of the neighborhood groups.

In an effort to not reinvent the wheel, the committee is looking to join the individual neighborhood members into a working micro-community. In this way, each neighborhood can look after their own as much as possible and work in conjunction with other neighborhoods to support and supply their members as necessary.

As of this writing, one additional awareness event drew several hundred people in mid-November that was more technical in nature than their first event and another is planned for December or early January. The November meeting delved into shelter, water and food issues with an in-depth overview of finances and the economy provided by Drew Parkhill, Y2K Editor for The Christian Broadcasting Network (CBN).

As their efforts continue to expand, the committee believes they will be able to more actively address community preparation issues and invigorate the neighborhoods to come together for the common good.

Eugene, OR, Starts From the Top - Down

Cynthia Beal, owner of the Red Barn Natural Grocery in Eugene, OR, began reading about Y2K in the summer of 1997. As a small business person she was extremely concerned about not only the company computer, but also the computers of her food suppliers and their transportation companies.

Armed with Y2K computer glitch information, she discovered that her company's computer was not Y2K compliant. She then purchased additional software to supplement her system to later find out it was not compliant either. She then went to the manufacturers of the software and demanded to know what they were going to do about it. Both responded there would be updates in the future for her to install prior to 1/1/2000.

After taking on the software companies, Beal turned her energy toward the local food bank, as the director was a friend, and she hoped they could benefit from her recent Y2K experiences. Incidentally, they were not compliant either and so began what has become quite an extensive community preparation effort due to one woman's computer software dilemma.

In October 1997, Beal began systematically contacting her utility companies to determine if they were Y2K compliant. After that she contacted her bank and while subscribing to Peter de Jager's on-line newsletter for the free month, Beal posted a plea for help in a chat room. That plea was answered by Harlan Smith, a member of Computer Professionals for Social Responsibility. The eMail said that they were going to help her and Eugene in any way they could.

After that eMail a power forum was held with Rick Cowles, formerly of Digital Equipment's Y2K Remediation Project and the Bonneville Power Administrator. The meeting drew approximately 20 people from 3 utilities and their local government. Since then, several members of their local governments have taken up the cause of neighborhood and community preparations for Y2K.

Founded on the concept that the governments should do their best to become Y2K compliant, the Eugene effort is aimed at mobilizing governmental resources and organizing the 17 neighborhoods and their associations that already exist. As of this writing, 2 of 5 city councilpersons and 2 of 5 county commissioners support the initiative. As soon as an additional councilperson and commissioner join the effort, then countywide efforts on the governmental level should commence. Currently, approximately 2000 individuals are joining forces through neighborhood and home groups to build their community preparation efforts into a unified voice.

For the Common Good

All three of the communities discussed here have one goal in mind - Y2K community preparation should the need arise. Each has taken a path that is at once similar yet unique for their own communities. Shouldn't your community prepare for possible Y2K disruptions?

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

National Efforts

by D.L. Moore

Colorado Springs, December 6, 1998 - Tucked away in a small, non-descript meeting room in Colorado Springs CO, approximately 40 people, representing several national Christian organizations, came together to discuss Y2K, community preparations and the Church.

Sponsored by Mission America, a coalition of 65 denominations based in Minneapolis MN, the meeting was the first such gathering of prominent members of the Christian community who represent literally millions of individuals throughout the United States.

Dr. Cornell "Corkie" Haan, an ordained minister for 34 years, serves as the National Facilitator of Network Ministries for Mission America and served as meeting chair and discussion facilitator for the day.

Additional luminaries in attendance included (alphabetical by organization):

Allan Beeber, Campus Crusade for Christ, Orlando FL; Chris Mitchell, The Christian Broadcasting Network, CBN News, Virginia Beach VA; Derek Packard, Christian Satellite Events Group (CSEG), Double Vision Studios, Sacramento CA; Ron Wilson, Focus on the Family ministry, Colorado Springs CO; Dale Moseley, Greater Love Disaster Relief & Community Preparation, Bend OR; Margaret Jamal, Hope for America, North Glenn CO; Drs. Mark and Betsy Neuenschwander, International Health Services Foundation (IHSF), Colorado Springs CO; Shaunti Feldhahn, Joseph Project 2000, Woodstock GA;

Cindy and Mike Jacobs, Generals of Intercessories, Colorado Springs CO; Don Jacobson, Multnomah Publishers, Sisters OR; Mike Carlisle, North American Mission Board of the Southern Baptist Convention, Alpharetta GA; Gordan England, Promise Keepers, Denver CO; Mike Hyatt, VP, Thomas Nelson Publishers, Nashville TN.

Much discussion revolved around Y2K and the implications for community preparation and contingency planning. Mission America currently is working on a national initiative called Celebrate Jesus 2000 with hopes of reaching approximately 3,000,000 to 5,000,000 people with the Gospel by 1/1/2000.

Y2K adds a new dimension to their efforts and at the end of the day a committee chaired by Feldhahn, and composed of Beeber, England, Wilson and the Neuenschwanders will prepare by Jan. 20, 1999 a statement of purpose, vision, values and outline strategies for meeting Y2K and the Church's needs around the country.

"The Mission America meeting here in Colorado Springs represents the latest effort of the Church to respond on a nationwide scale to both the potential disruptions and opportunities to Y2K," said Mitchell in his report for CBN News shown Dec. 9th.

CBN was the first to hold a meeting of national scope with their Y2K & the Church conference in Virginia Beach in October of this year (see Iss. 1 Vol. 10 article). Attended by over 320 people from 35 states, the conference was truly a "national effort".

Will They or Won't They?

Will they or won't they affect how churches around the country address Y2K within their own congregations and their communities - only time will tell. However, time is running out to begin preparing for Y2K and possible disruptions. In the meantime, other Christian-based organizations are turning considerable time and energy towards alerting people to Y2K and training them for the possible consequences of that now infamous

programming "boo-boo" of yesteryear.

Modest Beginnings Lead to City-Wide Meeting

Several months ago, 5 pastors gathered in Sacramento CA to discuss Y2K and possible disruptions to their churches and communities. A few weeks later the group met again but by then their numbers had grown to 20 clergy members.

The Y2K Readiness Seminar Series is in response to the pastors' request for a way to assist churches in other communities all across North America in educating their members and members of their communities about Y2K, community preparation and contingency planning.

If You Attend - What to Expect

If you're reading this article then you've probably been investigating Y2K for yourself, your family and your community. As quite possibly the biggest global event in history, Y2K could be merely a blip on computer screens around the world to manifesting serious physical, social and political consequences - no one knows for sure.

The first seminar brings together several Y2K speakers to discuss various aspects of Y2K and community contingency planning. As with unexpected natural disasters - emerging perhaps a little worse for the wear afterward is due in no small part to pre-disaster preparation and contingency planning.

Christian Financial Concepts President and financial expert Larry Burkett will provide attendees with an overview of Y2K financial implications and how to prepare. Shaunti Feldhahn, founder of The Joseph Project 2000 and the author of the recently published Y2K The Millennium Bug: A Balanced Christian Response will talk about Y2K and the Church.

Michael Hyatt, VP at Thomas Nelson Publishers and author of The Millennium Bug will discuss the effects of Y2K locally and globally. Y2K expert, Jim Lord will address Y2K and the business community.

The speakers will participate in a specially facilitated Q&A session designed so each location has the opportunity to address their questions directly to the speakers during the broadcast. Additionally, several communities around the country who are preparing for Y2K on a church and/or community level will be introduced to the viewing audience including Harbor Light Community Chapel in Harbor Springs MI (see Iss. 1 Vol. 10 article)

and Praise and Prayer Fellowship, the 1st Joseph Project chapter in Woodstock GA (see Iss. 1 Vol. 11 article).

All Under One Roof

The broadcast is broken into 6 segments and begins at 8:30 a.m. Pacific time on Jan. 23rd. The sessions are as follows:

Segment 1: Evidence of the Y2K Problem

Segment 2: 3-Family Preparation Scenarios

Segment 3: The Importance of Teamwork

Segment 4: Why & How Churches Should Prepare

Segment 5: Small Business - Preparing Your People

Segment 6: Y2K Lighthouses Project

Segment 6 teaches Christian families how they can help their unchurched neighbors become prepared physically and spiritually for Y2K.

Taking It to the Masses

As Y2K complications begin to surface, more and more communities will need to address possible Y2K-induced problems on a community-wide basis. Heretofore, satellite broadcast distance learning has been the domain of educational institutions.

By harnessing technology, CSEG is working to bring Y2K readiness information to churches and communities all across North America by providing the benefits of delivering time and event sensitive Y2K information without the hassles and delays of organizing local, state and regional Y2K conferences.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

BCY2K - Making a Difference in Boulder

--UPDATE--

HARBOR SPRINGS, MI, January 28, 1999 - Rev. William "Bill" Mindel, pastor of Harbor Light Community Church in Harbor Springs, MI, has announced their Y2K Community & Individual Preparation Conference slated for Friday, February 26th and Saturday, February 27th.

Speakers will include noted Y2K authorities Dr. James Gauss. Randall Rice, David High and Rev. Mindel. Those interested in attending should call (616) 347-5001, Monday-Friday 9-5 p.m.

The Boulder County, Colorado Y2K Community Preparedness Group (BCY2K) began rather inauspiciously in early Spring, 1998. A group of friends came together in an informal meeting discussing possible Y2K computer problem scenarios and how they might impact their community. From that humble beginning, Boulder County and Boulder City's Y2K efforts have increased more than a hundredfold, to include participation from governmental agencies to individuals and neighborhood groups from every corner of the county and beyond.

But how did they do it in such a short time, you ask? Well, their determination and organizational savvy are two traits that have helped propel them to the national forefront in what communities can do to help prepare themselves and their citizens for Y2K.

A Circle of Friends

Sitting in that circle of friends last spring was John Steiner and his wife Margo King. Both describe themselves as activists, networkers and "professional" catalysts. As founding members of BCY2K, Steiner and King brought previous community concerns, including environmental issues and creating sustainable communities, to the group's Y2K efforts.

By April, BCY2K had developed a mission statement to help them maintain focus over what was to become an extensive and intensive journey down the road of Y2K community preparation. Kathy Garcia (email - garciak@worldnet.att.net), founder/coordinator of Boulder's Holiday Food Basket, which feeds approximately 800 families and distributes toys and coats, became the neighborhood organizer for BCY2K.

In May 1998, BCY2K contacted Paloma O'Riley, the co-founder of The Cassandra Project (http://www.cassandraproject.org), a nationally recognized Y2K community preparation organization dedicated to equipping individuals and communities with the necessary information to prepare for Y2K. The Cassandra Project furnished preparation information to the group and O'Riley provided guidance in preparing Boulder for Y2K.

BCY2K immediately began work on defining task forces to research and develop strategic Y2K community preparations plans. Task forces include:

• Utilities

• Sewage

• Water

• Water

• Food

• Healthcare and delivery systems

• Emergency services and security

• Business

• Communications

• Transportation

• Outreach: media and educational materials

• Neighborhood, constituency, community organizing

• Essential financial services, alternative economies

• Y2K Volunteer Network

• Crisis intervention, counseling, social services

Y2K and the Community-at-large

Together, BCY2K, The Cassandra Project and the University of Colorado at Boulder (CU) hosted a "Y2K Computer Problem Public Awareness and Preparedness Seminar" August 20 - 23, 1998. Preeminent authorities from around the country addressed issues such as finance, electricity and utilities, healthcare, the economy and telecommunications, providing attendees with an in-depth understanding of possible scenarios and consequences of Y2K.

Speakers included: Jim Lord (personal finance), Roleigh Martin (critical societal infrastructure), Paloma O'Riley (individual and community preparedness), Kathy Garcia (neighborhood organization), Joel Ackerman (healthcare), Steve Davis (city and county governments); Cathy Moyer (Free Market Society), Chris and David Hubbard (medical preparation), Lewis Hagler (home preparedness: A Mormon Approach), Cynthia Beal (the Food Chain), Colleen Corbo and Annie Brook (psychology of crisis), Ron and Susan Kertzner (emotional preparation) and Sally Martin (dealing with elected officials), to name a few.

Held over four days, the Thursday and Friday sessions drew people from all walks of life from Boulder County and beyond. Several local utilities, governmental agencies and other community groups were in the audience. The Saturday and Sunday sessions were special presentations by CU faculty members and Margaret Wheatley, author of Leadership and the New Science, on community planning approaches for Y2K. More than 700 attended different session seminars throughout the conference. During the conference, a great deal of informal networking occurred that ultimately helped seed BCY2K's community organizational efforts.

Working from the Top - Down

The Monday after the conference, BCY2K members met for the first time with members of the Multiple Agency Coordinating System (MACS), which is led by the Office of Emergency Management (OEM) for Boulder County. The county is comprised of nine towns and each town contributes MACS representatives from their local police and fire departments, Red Cross chapters, risk management and planning departments, CU and school districts. MACS currently has three private citizens among their ranks working on Y2K community preparations.

"What is as unique as our location is the cooperative spirit of local government, our citizens and local media." said Richard Varnes, City of Boulder Y2K Project Manager. " The BCY2K has partnered with businesses, utility companies, the city and county, the newspaper and their fellow citizens to prepare for Y2K and possible natural disasters. Throughout the U.S., such progressive cooperation is rare for any reason, let alone Y2K."

Already working with local governmental agencies and departments through MACS, BCY2K received additional support from the City of Boulder. BCY2K uses city stationery for written communications and the Boulder City FYI line includes an area dedicated to BCY2K's Y2K community events.

BCY2K has gone on to sponsor educational meetings with local farmers/growers, religious leaders and communities, Hispanic community leaders and groups; healthcare providers and Boulder Community Hospital and human service agencies. Remarkably, young people from around the county have come together to form a Certified Emergency Response Team (CERT) to help with all natural disasters in addition to assisting low income families and the elderly in weatherizing their homes or trailers.

"One of the most important aspects of our efforts is bringing the community together. A very real benefit to Boulder has been building a stronger community fabric." said BCY2K neighborhood organizer Garcia. "Working with the various groups helps strengthen our entire county while building community awareness for Y2K and preparedness."

"Empowering people to confront not only Y2K and other natural disasters is important. Community preparation has been a catalyst for other cooperative initiatives in various communities. Who knows where all this cooperation will lead. Perhaps Boulder will emerge a stronger community as a whole through this process." Garcia reflected.

County Meetings

After the August conference, BCY2K began an every six weeks series of town meetings. On October 4th, over 400 people (standing room only) attended their town meeting that included representatives from Public Service (utilities), US West (telephone), City of Boulder, OEM, The Cassandra Project and Boulder Community Hospital. Local OEM head Chief Larry Stern told the audience they needed to take Y2K seriously and prepare individually and as a community.

Following that meeting the "flood gates were open", so to speak. Every week 3-4 community groups or organizations join BCY2K's Neighborhood initiative. Said Steiner and King, "The more we can do to raise awareness and the more people we can get involved and actively participating in building community preparedness and sound contingency planning for Y2K or other natural disasters, the more we can be prepared for whatever happens." Beginning in 1999, BCY2K began holding meetings every month in various locations throughout the county.

"Boulder is a remarkable city and county by being so forward thinking and proactive in planning for Y2K." O'Riley said. "I hope the care and effort they are expending here can be replicated around the country. Both the city and county endorse the effort of BCY2K and The Cassandra Project to educate and facilitate community preparations for Y2K."

King adds, "Y2K is a clear wake-up call that we live in a society that is very fragile and brittle. Whether Y2K is serious or not, environmental issue, i.e. global warming to non-sustainable living are forcing us to turn our attention to building communities that are viable and resilient into the next century."

About Us

The Trades Publishing Company, Inc.

Well into its second decade of producing top-quality targeted information resource and reference directories, Trades Publishing is an established publishing concern, printed by the USA Today ® staff at Gannett Offset in Nashville, Tennessee.

Our publications successfully address linking specific needs with supplies and services. The Golf Course Trades, The Parks and Recreation Trades, and The Resort Trades have all emerged as industry standards for their respective markets.

The same determination and focused dedication to purpose has launched Y2K News Magazine, a bi-weekly publication providing total global coverage on Y2K problems.

We hope to encourage creative thinking, practical solutions, and a certain liveliness in this ongoing exchange of ideas.

The days ahead will demonstrate that informed action is the key to survival. Y2K News Magazine is your resource for readiness, a reference for effective participation in the making of your own future.

Submit your original articles

Y2K News Magazine is currently accepting submissions for publication in the print version of Y2K News Magazine.

Articles on any subject relating to y2k will be accepted, but it is preferred that submissions fall into one of the following categories:

- Current Events

- Government

- Business

- International

- Utilities

- Survival

- Technology

- Spiritual

Please note which category you feel your submission should fall into.

It is imperative that submissions be completely editorial in nature. Submissions advertising a special product or service will be returned. Limit advertorial content to the information in your bio.

All submissions become the property of Y2K News Magazine and will be provided without compensation.

Company Guidelines for using our discussion webs:

1. We understand that disagreements will arise; however, please try to be polite and courteous to others. "Flaming" posts will be deleted by the moderator and warnings issued.

2. Please try to focus your discussions on the specified topic. Excessive irrelevant posts will be deleted by the moderator.

3. Posts will be cleared periodically.

4. Please do not post advertisements on these forums.

5. If you do not abide by the guidelines, you may be banned from these forums.

User developed Guidelines for using our discussion webs:

--The standard "Please do not post advertisements on these forums" applies. These forum users are seeking information and supplies to prepare for Y2K. Recommendations are very appropriate if they are first hand and no compensation exists. When a business makes an obvious SPAM to the forum, the users note it and as a result that business tends to get a cold shoulder - so why do it and hurt your business reputation? Let word of mouth do your selling.

--Realizing a lot of information already exists within the forums, please use your browser menu options and perform a "Find" search of the forum and look for your topic (Key word search). Please do this before you post a question (same net rule as FAQ Boards). This will reduce repetition.

--Prior to using a name or nickname, perform a search of the forum to see if others currently use it. If you want to use BOB, for example, and there is another participant using that name, you might want to use Bob4, Robert, Bobby, etc.

--The Post function makes your submission a top level, stand alone question. It is a "new" question, not follow-up remarks.

--The Reply function will install your reply under (and indented) to the question or response you have on your browser at the time.

--When you Post or Reply do not "double click", doing so will submit the item twice and wastes valuable space.

--After writing either a Post or Reply you send it by pressing the Post Article button found below the Comment section.

--If you can Reply with a very short answer (60-70 characters) feel free to change the information in the Subject line, but please note that using the Subjector From line to answer at length bogs down the page and increases loading time. Use the Comment section for your 70+ character space comments.

--If/when you do reply with a short amount of text in the Subject block, it is kind to let others know it is not necessary to click on your submission: This is done by placing an "nt" or "NT" (for No Text) just before your name/nickname. (Do not put "nt" in subject line because it will duplicate when others reply and possibly mislead future readers)

--If you click directly on the link (a Question or a Response) you will eventually do a Back or Return to the forum. When you do this, the entire forum must be reloaded. This wastes your time and adds to bandwidth usage. TIP: Consider opening a "second" browser. At the Forum (Browser #1) right mouse click on the link and select "Copy Shortcut." Go to the second browser and paste it in the Address/URL window and press enter. From there you can work that specific thread. Periodically refresh the forum window to note the new posts.

The electronic messages that appear on these forums are for informational purposes only. They are not intended to be and should not be considered legal or professional counsel or advice, nor substitute for obtaining legal or professional advice from competent, independent, legal or professional counsel in the relevant jurisdiction or profession.

Transmission of this information is not intended to create, and receipt does not constitute, an attorney-client relationship, nor a relationship of consultancy. The information contained in these forums may or may not reflect the most current legal or actual developments and should not be relied upon to make decisions of any substantial nature.

The views and opinions expressed are not necessarily those of The Trades Publishing Co., its Publisher, or any staff members.